As The Foundational Basis For Wealth

Using TAX S.M.A.R.T. Planning

Our purpose is to help our clients retire tax efficiently successfully, and enjoy tax minimization through all four phases of wealth.

Welcome to 9 To Know, a quick and easy way to take a look into your financial future.

Here you can obtain a complimentary basic tax and financial analysis by entering 9 pieces of contact and financial information.

This analysis can help determine if you are on track for a successful retirement or if you may come up short. If you find the analysis doesn’t match your desired results, we could provide recommendations that may help you attain your tax and financial goals and improve your retirement picture.

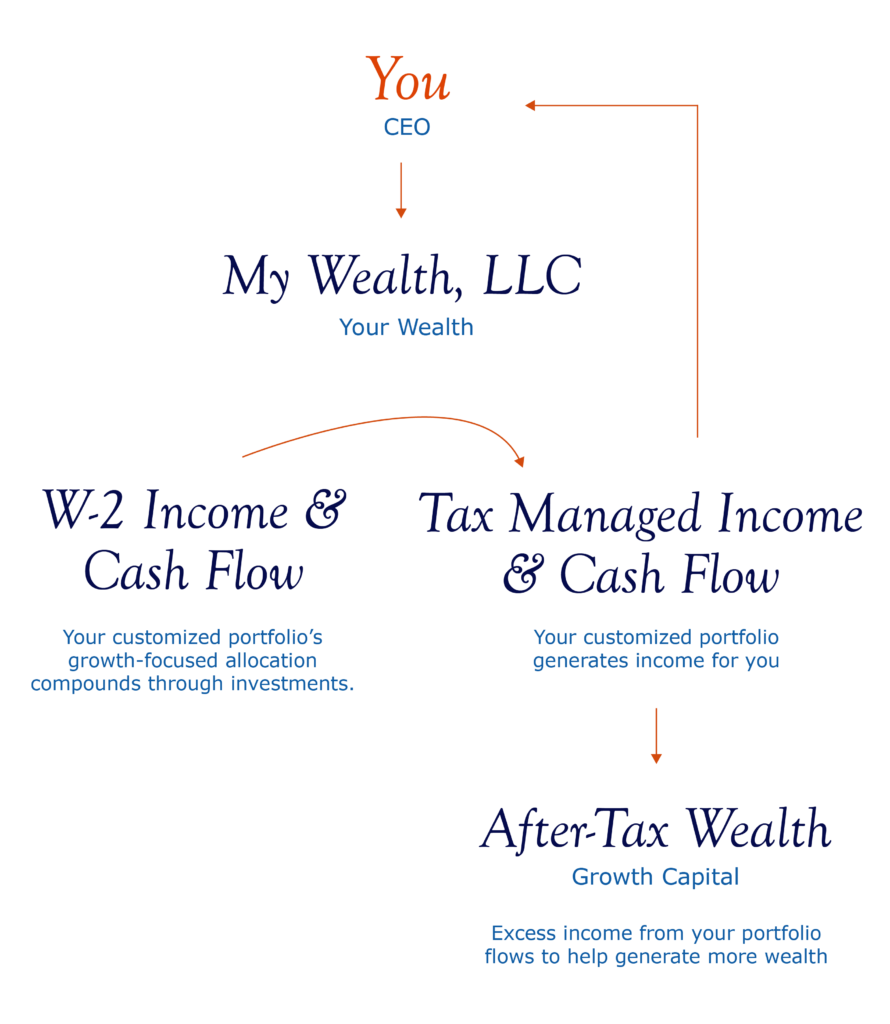

We view your wealth as your most important business.

Serving as your Chief Tax Strategist, Harbour Pointe helps you create strategies that optimize your wealth. As the owner and CEO of your wealth, you are at the forefront of every decision.

Not All Assets Are Taxed Equally

Taxable

Tax Deferred

Tax Free

The 5 Step Tax S.M.A.R.T. Process

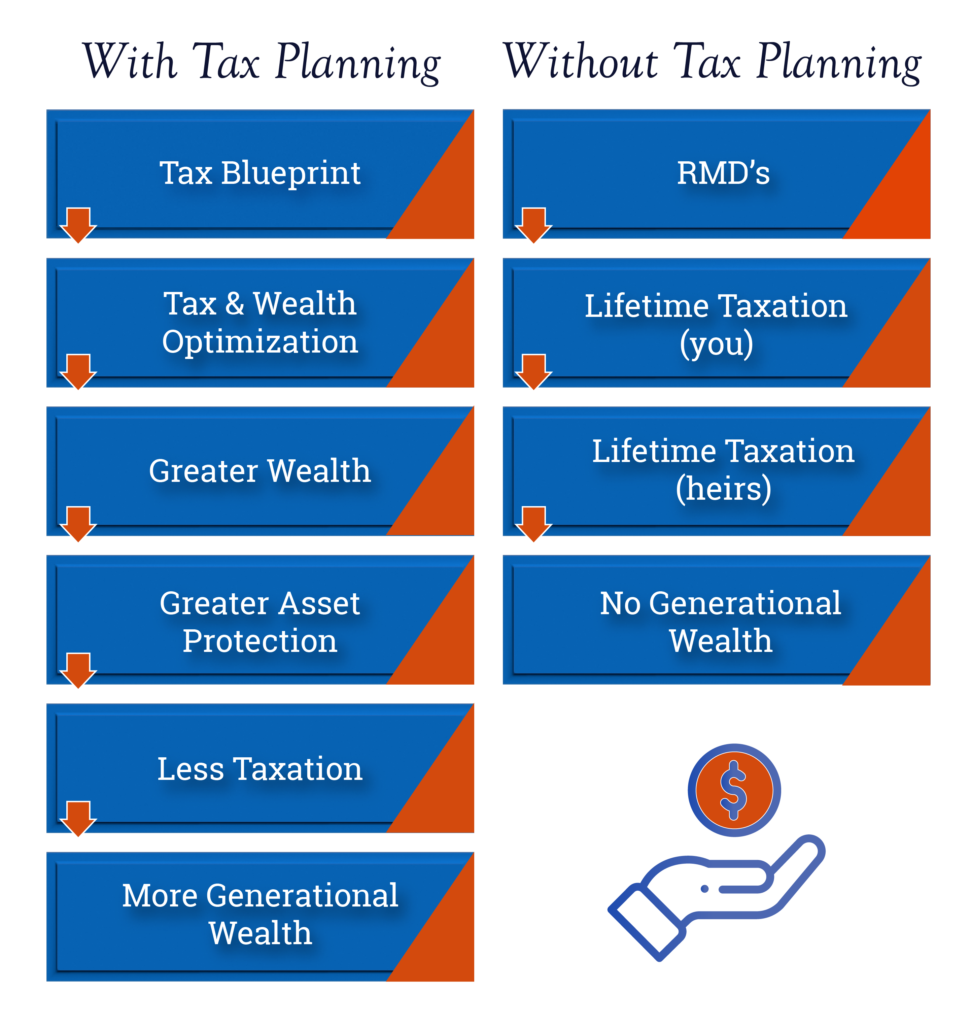

We use our 5-Step Process as a Foundational Tax Blueprint for building customized and tax optimized wealth management, preservation and transfer strategies focused on the tax conscious investor’s goals and objectives. Whether it’s lifetime tax minimization, asset protection, or generational wealth strategies, we use a customized and creative approach developed specifically by a Tax Attorney to target long term goals.

Portfolio

Audit

- Analyzing the portfolio’s expenses

- Identifying opportunities for optimizing investment securities

- Minimizing excess investment costs and trading costs

- Recommending diversification, yield, and asset allocation opportunities

Investment

Management

- The 4-Quadrant Equity Approach: Advanced investment strategies targeting capital appreciation while keeping costs low

- The 4-Quadrant Fixed Income: Targets a customized yield using a mix of strategies to create low-risk, diversified income

- The 4-Quadrant Alternative Investment Approach: Complements equity investments with a combination of private investments and strategies to optimize returns

Customized Tax Planning

& Preparation

- Analyzing previous tax returns for optimization opportunities

- Identifying & recommending tax-advantaged investment opportunities

Advanced Tax

Planning

- Assessing low-cost lending solutions

- Setup & access to Harbour Pointe Tax Advisory System (HPTAS) tax optimization software

- Creation of financial plans, including cash flow plans, retirement plans, education plans, estate plans, insurance plans, & charitable giving plans

- Executive compensation

- Equity compensation

- Beyond IRMAA

Advanced Estate Planning

- Overseeing asset transfers while eliminating income, inheritance, generation skipping and estate taxes

- Special Planning for blended families

- Irrevocable Trusts

- Sale of a Business

- Sophisticated Asset Protection

Tax & Wealth Optimization

Instead of a rolodex of different attorneys, managers, and consultants, Harbour Pointe brings all the disparate areas of your wealth together under one roof.

Through our 5-Step Tax & Wealth Optimization Process, our advisors work with you to create customized financial plans and a portfolio that helps you sustain your ideal lifestyle.

Independent & Fiduciary Advisors

We serve our clients as independent, fee-only fiduciaries. Our clients always receive independent advice free of any conflicts of interest.

Independent

An independent financial advisor is one that cannot receive commissions from recommending investments.

Truly independent wealth management advisors are fee-only, minimizing any conflicts of interest.

Fiduciary

A fiduciary financial advisor is one who always and only acts in the best interests of their clients.

Fiduciaries are bound by the Fiduciary Standard, which requires advisors to always put the best interests of clients first.